Gas mileage compensation calculator

If use of privately owned automobile is authorized or if no Government-furnished automobile is available. For example if Car 1 gets 25 MPG Car 2 gets 20 MPG gas costs 320 per.

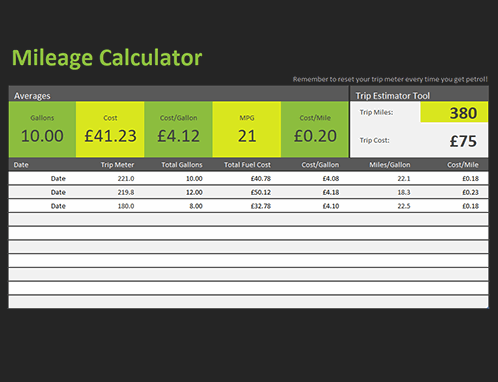

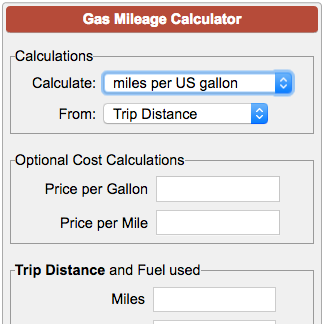

Mileage Calculator

Get total trip cost and mileage breakdown - mileage rate tracking mileage report gas tolls etc.

. Gas Mileage Calculator Mileage Calculator The price of gas may go up or down but its always a major expense for most drivers. Multiply the standard mileage rates and miles. Ad Track All Expenses Mileage IFTA Driver Truck Records in a Breeze.

15 rows Standard Mileage Rates. Gas Mileage Calculator An easy way to calculate gas mileage is to remember the odometer reading or to reset the mileage counter when filling up a gas tank. The IRS sets a standard mileage reimbursement rate.

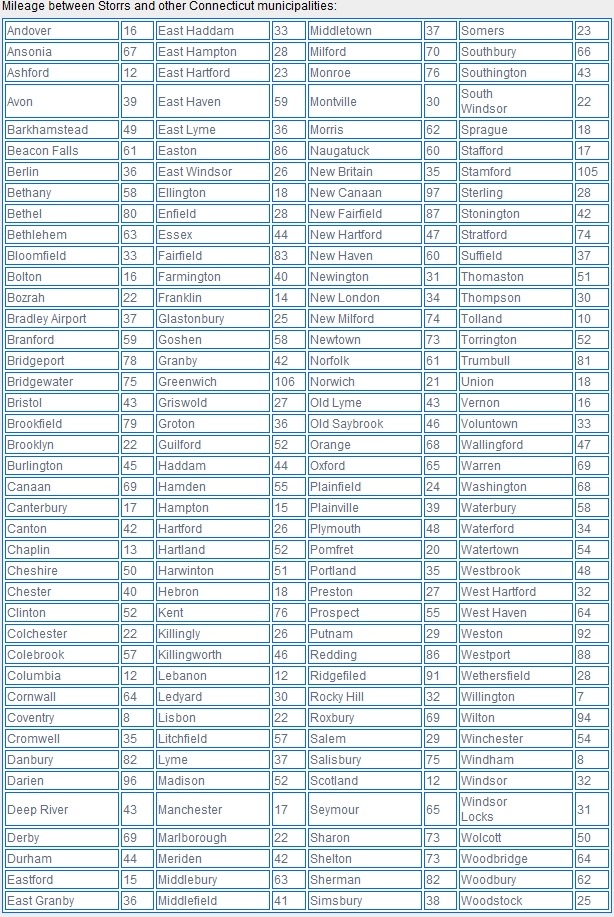

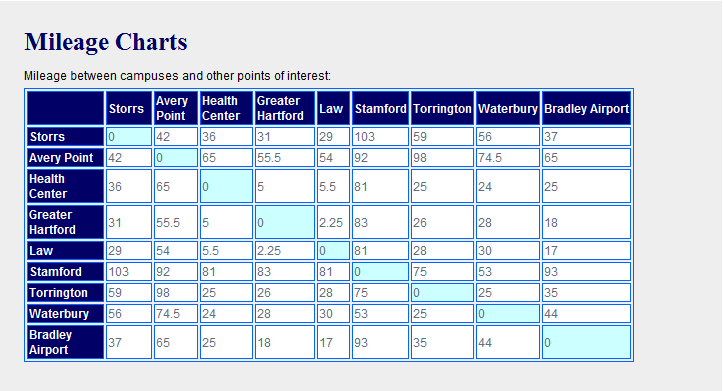

MINI Cooper SE Hardtop 2 door. 8 miles 585 cents 3 miles 18 cents 14 cents 5 miles 600 Your estimated mileage deduction is 600. Type the location name in the From and To fields.

Automatically track your deductible mileage with greater accuracy ease. To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer. Reimbursements based on the federal mileage rate.

The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the. Keep in mind that this. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

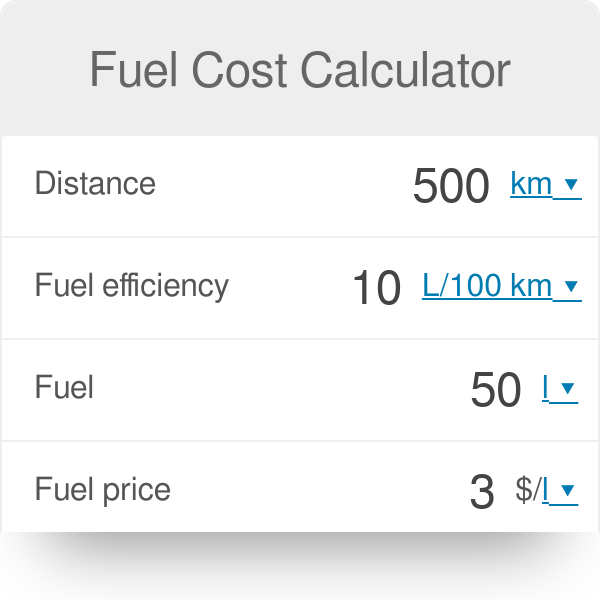

For example lets say you drove 224 miles last month and your employer. This calculation can be in US dollars on any other amount of. This script determines the compensation due from a number of miles driven based on a mileage fee of a set amount.

For the final 6. After you have filled out all the fields hit calculate and the calculator will tell you the gas costs for each car. Select the location from each drop down.

Ad Track All Expenses Mileage IFTA Driver Truck Records in a Breeze. For example if the standard reimbursement vehicle gets 225 mpg and the gas prices are 550gallon we calculate the gas rate to be 2444mile. 15 day trial available.

When doing so next time. For a location missing from the drop down type a street. Log your mileage and gas expenses using this gas mileage tracker template that calculates the average price per gallon miles per gallon and cost per mile.

Ad Track mileage expenses accurately reimburse using GPS data. Rate per mile. Try Mileage Reimbursement Calculator.

Use latest IRS reimbursement rate for work medical. For 2020 the federal mileage rate is 0575 cents per mile. The average American driver spends about 3000.

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

How To Calculate Your Mileage For Reimbursement Triplog

Mileage Calculation Accounts Payable

Free Mileage Log Template For Excel Everlance

Mileage Calculation Accounts Payable

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

How Do I Submit Or Claim Mileage In Concur Expense Sap Concur Community

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

2021 Mileage Reimbursement Calculator

Gas Mileage Calculator

Mileage Calculator Credit Karma

Trip Cost Calculator Fleet Management

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Fuel Cost Calculator

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Irs Mileage Rate For 2022

Mileage Reimbursement Calculator